The right to a just wage, or a living wage, is one of the cornerstones of Catholic social teaching. Blessed John XXIII probably put it best when he said that “the remuneration of work is not something that can be left to the laws of the marketplace; nor should it be a decision left to the will of the more powerful. It must be determined in accordance with justice and equity; which means that workers must be paid a wage which allows them to live a truly human life and to fulfill their family obligations in a worthy manner.”

Clearly, the responsibility to pay this wage lies with the employer, the business. And yet, this is too often given short shrift in the economic and political debate. For the right, the only just wage is the market wage – this is ethical in that in rewards effort and it is efficient in that anything higher would lead to unemployment and so hurt workers. The left is certainly more concerned with issues of justice in wages. But even here, there is a strong tendency to defer to the prerogative of business and the iron law of the market and focus instead on the role of government in “topping up” received wages with social benefits. Indeed, both sides often align in supporting in-work benefits such as the earned income tax credit – because it both boosts the wages of the poor and does not “distort” labor markets.

Now, Catholic social teaching has always defended social benefits. And prudence dictates that we should certainly support programs like the earned income tax credit that have been shown as effective in reducing poverty. But at some fundamental level, this is letting the employer off the hook. Providing workers with a living wage is a strict duty of justice. It is an obligation.

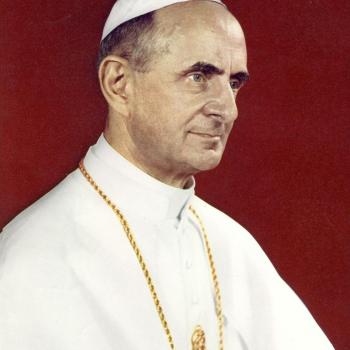

This can be seen through the prism of the different types of justice. As Thomas Storck has argued, paying a just wage is part of commutative justice, the justice of exchange and contract between two parties. The worker agrees to provide his/ her labor and the employer is “obliged strictly” to pay a just wage. This comes directly from Pius XI. Not paying a just wage is akin to not paying a contracted debt. For sure, we can easily think of extreme circumstances in which businesses will not be able to pay either debts or wages, but I want to focus here on normal times.

We can also look at this from the perspective of distributive justice, the way in which society distributes its common resources to meet the needs of all. John Medaille has written a number of thoughtful papers from this perspective, arguing that the just wage is related to the distribution of resources among the factors of production (labor, capital, land) that comes prior to any exchange. This fits with the emphasis of Blessed John Paul II on the priority of labor over capital, and his view that a just wage is the best route toward the universal destination of goods in modern society.

So the justice inherent in a “just” wage is both commutative and distributive. But social justice also comes into play – as Pius XI said so clearly, “it is of the very essence of social justice to demand for each individual all that is necessary for the common good”. But this only works if each person “is supplied with all that is necessary for the exercise of his social functions”. When it comes to wages, as Thomas Storck notes, this has a clear implication: if the employer is not able to pay a living wage owing to circumstances beyond his control, the authorities must step in and make the necessary social and institutional changes. As Pius puts it, “social justice demands that reforms be introduced without delay which will guarantee every adult workingman just such a wage”. It doesn’t get much clearer than that.

As Blessed John Paul II put it, “a just wage is the concrete means of verifying the justice of the whole socioeconomic system and, in any case, of checking that it is functioning justly”.

Note that this differs from the neoclassical approach, which assumes that workers are paid in line with marginal product and the economy is always at full employment. But we know this isn’t true in practice. Furthermore, newer approaches to labor economics see wages more as the outcomes of a bargaining process between workers and employers, with the outcome depending on the relative bargaining power of the parties.

The question really boils down to whether higher wages will lead to lower employment or lower profits. This is, of course, a prudential question. But as evidence, just look at trends in the United States over the past three decades. Real wages have fallen far behind productivity, real median income has stagnated, and the profit share has risen sharply. Most of the gains in growth went to profits and capital income. In other words, there is more evidence for the bargaining power explanation than the neoclassical explanation, especially in light the weakened position of labor in recent decades. Putting it another way, workers have been the victims of a serious injustice.

What about the role of government? Here, I believe, the principle of subsidiarity comes into play, and it is no accident that Pius XI is the intellectual force behind this principle. Subsidiarity says that wage setting is the responsibility of the employer and the worker, determined under a balanced bargaining position between employers and unions. It is the role of the state as a higher level authority to provide the underlying conditions so that the lower level authority can reach a just outcome as effectively as possible.

This includes putting in place the proper legal and institutional framework, pushing ahead with social and institutional change if necessary. It includes legislation of minimum wages – yes, employers should not pay a living wage solely because the government tells them to, but we need the force of law nonetheless. (think about it: we also have a duty not to kill, but we also need laws against murder!). And it includes the kinds of social protections that flow from our common dwelling in a market economy, such as unemployment insurance and social security.

This is not to say there is no role for direct interventions in the labor market that go beyond the minimum wage. Think about a deep recession. In such a case, a business has the choice of letting workers go, or cutting wages across the board. The second option is better for the common good, and the government is justified in providing wage subsidies for a specific period of time to help business protect workers. This is the basis of the famous German Kurzarbeit system, and it worked really well during the global financial crisis. And certainly, we can think of plenty of circumstances whereby in-work benefits like the earned income tax credit serve a useful social purpose, such as targeting assistance to certain marginalized groups.

In a globalized world, these issues have important cross-border dimensions. If one country insists on better wages, a company is too easily able to slip across borders to a more “business-friendly” jurisdiction. This is especially perilous for poorer countries. Too many poor countries have entered a ruinous race to the bottom in terms of wages and labor standards, always afraid that another country will entice away business. This is a grave injustice, brought home to us by the devastating fire in the Bangladeshi garment factory.

But no single country, or single company, can fix this kind of global injustice, which is really a structural sin on a global scale. It calls for a cooperative response at the global level. Governments need to agree on minimum labor standards, committing not to undercut each other. In turn, corporations need to agree to pay decent wages and benefits when they enter these low-income countries. For example, they could agree to a voluntary code monitored by a strictly independent entity with fully transparent processes. And because the world is globalized – as the Church has recognized – we need a supranational dimension of oversight that goes beyond the prerogatives of the nation state.

Fundamentally, we need a new attitude on the part of business, an attitude that prioritizes the welfare of workers over maximizing profits and minimizing tax liabilities. We need a better recognition that business has a duty to society, a duty that comes with ownership of the means of production. By not paying a just wage, not only is business shirking its duty in justice but is forcing the taxpayer is picking up the tab.