The Today Show this morning presented its latest variation on the now-routine story "Five Ways to Improve Your Credit Score."

"It affects all portions of your life," Matt Lauer says in the introduction, "how much you pay for insurance, even whether or not you might get a job."

The report never challenges this "all portions of your life" expansion of credit scoring or questions why what was purportedly designed as a measure of credit-worthiness should be or should be allowed to be used for so many other reasons and decisions so far removed from that purpose. It's just a given.

Finance reporter Jean Chatzky bemoans the fate of the fourth of Americans who are forced to pay higher rates for everything from mortgages to insurance premiums due to their sub-600 credit scores, but it never occurs to her that this game shouldn't be played in the first place. Transunion, Equifax and Experian set the rules, even if they haven't bothered to tell us what those rules are. Ours but to follow those cryptic rules as best we can, paying all due penalties when we violate them.

Chatzky claims to have access to the secret formulas used for credit scoring — at least in the broadest outlines, so along with her five recommendations, she offers an estimate of what percentage of your credit score each factor constitutes.

1. Pay your bills on time: 35%

OK, sure. That makes sense. That's the sort of thing this measurement was meant to measure.

2. Limit your credit use/"credit utilization": 30%

"You only want to be using 10 percent to 30 percent on those credit cards of your total credit lines," Chatzky says. More than that — and perhaps also less than that — could harm your score. She suggests you keep all your credit lines in that 10- to 30-percent sweet spot.

Note already the capacity for a cascade effect. Miss a payment and your consequently lower credit score will lead creditors to reduce the amount of credit available to you. The $250 balance you were carrying on that $1,000 limit is now $250 on a $500 limit, so your credit utilization has magically shot up from the sweet spot of 25 percent to the flashing red warning sign of 50 percent — further reducing your credit score.

3. Keep old credit cards open and avoid credit you don't need: 15%

See, by closing those older cards, you reduce the overall size of your available credit, thereby increasing your credit utilization and lowering your score. Chatzky says it's the "length of your relationship with creditors" that accounts for 15 percent of your score. "Longer is better," she says.

Now we've moved into a realm where responsible, rational decisions can harm your credit score. It makes sense to close an older account with higher rates or fees, but doing so can harm your score and then saving money on those rates and fees will end up costing you money because of the rules of the game. This not only prevents consumers from reaping the possible benefits of competition, but it begins to show that this "score" doesn't really measure what it purports to measure.

4. Diversify your types of credit.

Having accounted for or guessed at 80 percent of the scoring formula in the first three items, Chatzky doesn't even guess at how this particular bit of advice is weighted. "They like to see … a mix," she says. "That you have the skills and the wherewithal to pay off a mortgage, to pay off a car loan, to pay your credit cards on time, to pay your student loans."

This doesn't quite make sense. If you pay off your mortgage or pay off your car loan, then you're reucing the "diversity" of your "credit" (she means "debt," actually, but it's common practice in these reports to use the terms interchangeably).

The unintentional slip here is Chatzky's belated acknowledgment that the main thing the credit scorers are looking for is "the wherewithal." She doesn't hazard a guess at what percentage of your score sheer brute "wherewithal" constitutes, but I'm guessing it's more than the 80 percent she thinks she's accounted for so far.

5. Avoid credit you don't need.

Lauer and Chatzky ran out of time, so we're not told what this means or what alleged percentage of our credit scores it makes up. That also leaves us guessing as to what "you don't need" means in the context of the previous three recommendations. Getting a new credit card would seem to increase your total available credit — thus reducing your credit utilization and improving your score, which Chatzky insists you "need" to do. And it might add to the "diversity" of your types of credit — also an apparent "necessity" in this game.

Don't get me wrong here. I don't think anyone should add more credit/debt just for the sake of adding more credit/debt. That strikes me as irresponsible and foolish. But if Chatzky is correct, it's just the sort of irresponsibility and foolishness that is likely to improve your credit score. That's how the game is played. (Or, at least, how NBC's financial reporter is guessing the game is played, since none of us has access to the actual secret proprietary formulas.)

Consider how the credit score as described by Chatzky creates powerful incentives to acquire, maintain and constantly use open lines of credit. Ponder the mutually beneficial coziness displayed here between the credit-rating agencies and the credit-card lenders and mortgage companies they work with.

A kick-back by any other name would smell as rank.

In any case, let me add a few of my own suggestions to the tips provided by the Today Show:

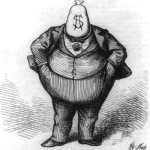

1. Make a lot of money.

Really, just a stinking boatload of money. The more the better. You don't necessarily need the "wherewithal" of a Bill Gates or a Carlos Slim, or even quite the wherewithal of a LeBron James. But you're going to want high-six-figure income, at least. Note that being stinking filthy rich is no guarantee of a high credit score. It's necessary, but it's not sufficient. The bottom line, though, is that if you're not at least second-home rich, then your credit score will never be as good as Bernie Madoff's was.

2. Pay your bills on time, all the time.

The easiest way to ensure this happens is to make a stinking boatload of money (see tip No. 1 above) and then to have all your bills automatically deducted from your account. If you're not filthy rich, be very careful with automatic bill payments. The usual suspects — Verizon, AT&T, Comcast, etc. — have a history of "accidental" overcharges or double-charges or inexplicable delays in crediting even automated, speed-of-light electronic payments, and if you're not at least flush enough to have plenty of margin for error in your bank account, then such "accidents" can lead to missed payments, late fees and the cascading collapse of your credit score. It's probably wisest then to have your accountant or one of the household servants monitor these automated payments to ensure they go according to schedule.

3. Establish credit by having wealthy relatives co-sign large loans.

A dismaying number of Americans have been woefully irresponsible in choosing their parents or grandparents. That foolishness is reflected, as it should be, in their credit scores.

4. Don't be a victim of identity theft.

You may recognize the picture to the right as the bank robbers from the film Point Break. But that's not quite accurate. Sure they went into a bank and extracted lots of money at gunpoint, but according to the new rules of the credit-scoring game, they didn't steal from the bank — they stole from Richard Nixon, Jimmy Carter, Ronald Reagan and Lyndon B. Johnson.

You may recognize the picture to the right as the bank robbers from the film Point Break. But that's not quite accurate. Sure they went into a bank and extracted lots of money at gunpoint, but according to the new rules of the credit-scoring game, they didn't steal from the bank — they stole from Richard Nixon, Jimmy Carter, Ronald Reagan and Lyndon B. Johnson.

This is what "identity theft" means. When someone steals from the bank while pretending to be you, the credit scoring agencies say they actually stole from you and not from the bank. After all, if I walk into a bank claiming to be you and empty out all of your accounts, whose job should it be to double-check that I really am who I claim to be? Not the bank's, certainly. So it must be your job and your responsibility, at all times, to make sure that no one, anywhere, is pretending to be you.

This is quite complicated and time-consuming, but for a price you can pay the credit agencies to help you do it. The most responsible step would be to pay each of the three credit rating agencies a monthly fee for this ID theft protection, as well of monthly fees to each of your diverse sources of credit, all of whom also offer this protection service. That can amount to more than $100 a month, but if that additional expense worries you, remember tip No. 1 above.