I’m sitting here musing on what would happen to church giving — and charities in general — if everyone had to make their tax returns public? Here’s a few paragraphs from the CNN Money news story:

“It’s between you and God,” you might say. I don’t blame you for saying that. Romney’s and Obama’s are not. And many were urging to see Romney’s — for criticism fodder.

But the real question for Christians is this: What happens inside you when this question is asked? “What would happen to your giving if your taxes became public?”

NEW YORK (CNNMoney) — Mitt Romney made $13.7 million last year and paid $1.94 million in federal income taxes, giving him an effective tax rate of 14.1%, his campaign said Friday.

His effective tax rate was up slightly from the 13.9% rate he paid in 2010.

The majority of the candidate’s income came from his investments….

Romney took $4.7 million in itemized deductions and $102,790 in foreign tax credits, which likely represents taxes paid on foreign investments to other sovereign governments.

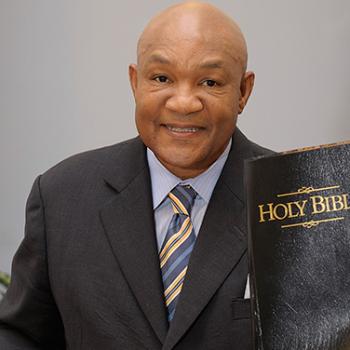

Romney and his wife, Ann, gave just over $4 million to charity, the campaign said. The amount includes more than $1 million in cash to the Church of Jesus Christ of Latter Day Saints and more than $200,000 to the Tyler Foundation, which serves families of children undergoing treatment for epilepsy. They also reported more than $900,000 in noncash contributions.

But the couple chose to deduct only $2.25 million of their charitable contributions. The reason was “to conform” to Romney’s statement last month that he never paid less than 13% in income taxes over the past 10 years, Brad Malt, a lawyer who presides over the Romneys’ blind trust, said in a statement.