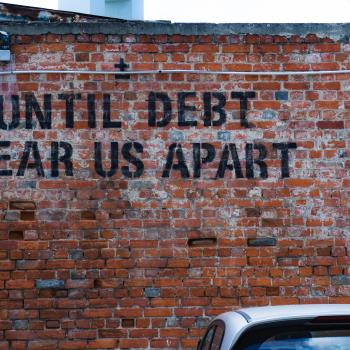

Debt is a major financial burden that can have you stressed out, living paycheck to paycheck, and could eventually push you into bankruptcy. Most people want to get out of debt, but they’re not exactly sure where to start.

Here are a few strategies that will allow you to break free from the bondage of debt – and some that you probably shouldn’t use. Some of these you can use concurrently, and others you’ll want to use one at a time. Do what’s best for your situation, and you’ll be out of debt sooner than you think. Here’s how to get out of debt.

The Best Strategies for Getting Out of Debt

1. Utilize “The Debt Snowball.”

Popularized by Dave Ramsey, the debt snowball is a systematic approach to paying off your debt. The first step is to make a list of all your debts. Here are two popular ways to prioritize your debt payoff plan:

- Smallest balance down to largest balance. This one is recommended by Dave Ramsey due to the motivation you will feel once you have some “quick wins” and pay off the small debts first.

- Higher interest down to lower interest. Paying off the higher interest rate loans first is the mathematically correct way to get out of debt, as you will have to pay less money overall in the long run, but it’s not very motivating when the higher interest rate is also your largest debt – you’ll have to wait longer to pay off a few debts.

Once you’ve prioritized your debts, you’re ready for the next step. Throw as much money as possible at the debt on the top of the list, and make minimum payments on everything else. Once you’ve paid off your first debt, take the money you would normally throw at the first debt and throw it toward the second debt while still paying minimum payments on everything else.

After awhile, you’ll gain momentum as you pay off your debts by being able to throw larger chunks of money at your debt snowball list. They call this one “The Debt Snowball” because like a snowball gathering snow as it’s rolling downhill, the amount of money you’re able to throw toward your debts increase with time.

2. Cash out your savings accounts.

How much money do you have sitting in savings accounts? If you have non-emergency money sitting in a savings account, why not throw it toward your debt? Remember, you could be saving a lot of interest payments by utilizing the money that’s just sitting around.

Let’s say you have a credit card with a balance of $4,500 with an 18% interest rate. You also have enough non-emergency money to pay off the debt, just sitting in a savings account. Now what if you could earn an 18% return on your money by “investing” $4,500 into your debts with zero risk? That’s essentially what’s happening when you use liquid money to pay off your debt.

3. Sell everything you don’t need.

If you don’t have the money in savings to pay off your debts, consider selling stuff you don’t need. Maybe you have an old car sitting on the front lawn that’s just been collecting dust, or perhaps an old record collection you can put on eBay. Whatever the case, get rid of the stuff you don’t need.

4. Cut up the credit cards and avoid borrowing in general.

It has been said that the first step to getting out of debt is to not go into any more debt. It’s true that if you can avoid new debt your old debt will disappear naturally with time – all debts have due dates!

Cutting up credit cards is one way to ensure you won’t go into any more debt, if that’s the way you’re accustomed to borrowing money.

5. Get an extra job to pay off debt quicker.

When you’re looking to pay off your debts, you have to get intense. One way is to get a side job! You can do anything from freelance writing to music lessons! Whatever it is, do it keeping in mind that the extra work you’re putting in is worth it and you’ll be out of debt in no time!

The Worst Strategies for Getting Out of Debt

These strategies should either not be taken or used as a last resort. Be careful when tempted to use these tactics for getting out of debt! They might be dangerous to your financial health.

1. Borrow against your life insurance.

If you have a cash value life insurance policy, you can borrow against it. While rates are typically lower than commercial rates, if you die without paying it back, your estate will have to pay it back which can be a burden on your family.

2. Borrow against your 401(k).

This is a bad plan because if you don’t pay back the money to your 401(k) within the time allotted, you’ll taxed on the amount borrowed plus a 10% excise tax as a penalty for an early withdrawal of retirement funds.

3. Borrow from family or friends.

When you’re borrowing from family or friends, you’re simply putting yourself in debt to new (and worse) collectors. How are they worse collectors? When you owe something to family or friends, not being able to pay them back can damage your relationship with them. They might also lord it over you and you may never want to see them again. Be very careful not to take this route! It destroys families and long-time friends!

There you have it! Those are the best and worst strategies for getting out of debt. What do you think?

How do you plan on getting out of debt? Leave a comment below!

This article was originally published on April 18, 2012.