The House just passed a budget resolution that does two astonishing things: first, it changes reconciliation rules to only require a simple majority instead of the 60-vote threshold in the Senate to overcome a filibuster. Second, it formally states the GOP intention to repeal the state and local tax deduction (SALT) on income taxes.

Big news – Budget just passed!

— Donald J. Trump (@realDonaldTrump) October 26, 2017

SALT is unequivocally a middle-class tax benefit:

The study, conducted by the Government Finance Officers Association using IRS data, found that nearly 40% of tax filers making between $50,000 and $75,000 in 2015 claimed the deduction. That is nearly 7.6 million households.

Of those making between $75,000 and $100,000 (6.9 million households), 53% claimed it, as did 76% of those making between $100,000 and $200,000 (13.9 million households).

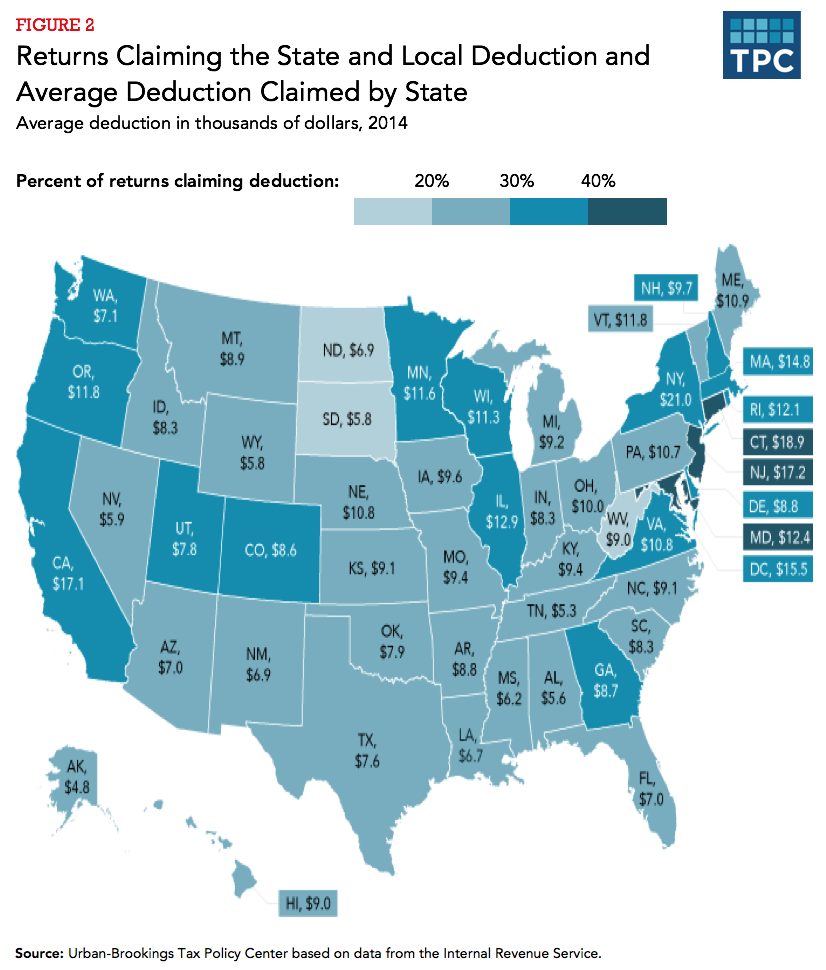

and not just in solid blue states, either:

But there are still Republican districts in Democratic states, and as Yahoo Finance demonstrated earlier this year, there are relatively high portions of taxpayers claiming the deduction in swing states such as Virginia, Wisconsin, Colorado and Michigan.

And of course, getting rid of SALT means you are essentially taxed twice – you pay taxes to the federal government, and you pay taxes to the state government on the taxes you paid to the federal government.

Why are the GOP looking to get rid of SALT? so they can make their immense tax cuts for the 1% revenue-neutral. That is literally the definition of taking money away from the middle class to give to the rich.

For ore information about the SALT deduction, see the Brookings Institution’s Tax Policy Center explainer on SALT, and this comprehensive report (PDF) on the fiscal impact of repealing SALT, jointly prepared by the Government Finance Officers Organization, the US Conference of Mayors, the Council of State Governments, the National Governors Association, the National Conference of State Legislatures, the National League of Cities, the National Association of Counties, and a few other orgs.